Pharmacists Mutual can offer comprehensive Executive Liability insurance coverage. This coverage includes Directors and Officers Liability, Employment Practices

Liability Insurance (EPLI) , and Fiduciary Liability.

We take pride in the fact that both non-profit and for-profit companies may be eligible to purchase our Executive Liability insurance options offered through our wholly owned insurance agency PMC Advantage Insurance Services, Inc.

For more information on products and coverage, contact your local field agent.

Directors and Officers (D&O) Liability Insurance

Directors and officers (D&O) liability insurance protects the company’s assets, as well as the personal assets of corporate directors and officers in the event employees, vendors, competitors, investors, customers, or other parties sue for actual or alleged wrongful acts in managing the company.

Any business with a corporate board or advisory committee should consider investing in D&O protection. Both for-profit and nonprofit companies may be eligible to purchase our D&O insurance.

Does My Business Need D&O Coverage?

DIRECTORS AND OFFICERS ARE SUED FOR A VARIETY OF REASONS related to their company roles, including:

- Breach of duty

- Neglect

- Error

- Misstatement

- Misleading statement

- Omission

DIRECTORS AND OFFICERS LIABILITY LIMITS AND COVERAGE OPTIONS

- Coverage limit options are typically $500,000 or $1,000,000 (higher limits are available).

- Coverage is available on a Claims-Made basis for claims made against your corporation for indemnification reimbursement.

- Premium is based on the company’s corporate structure, annual revenue, services provided, and the state of operation.

An application is needed with current financial information and a list of board members to obtain a proposal for coverage.

Contact us today for more information.

Kathy Struecker

800.247.5930, ext. 7256

PMCA_PC@phmic.com

Employment Practices Liability Insurance (EPLI)

In every business there is risk, unfortunately that includes risks involving your employees. Your company may feel like a family so it is hard to think of anyone filing a complaint. Pharmacists Mutual’s Employment Practices Liability Insurance (EPLI) could help protect you from the financial consequences of an employment-related lawsuit.

Are You Covered?

EMPLOYMENT PRACTICES LIABILITY INSURANCE

Keeping up with changes in employment regulations and changing public attitudes have created increased liability for employers. Even the most diligent employer cannot control human behavior, and one incident can leave you and your business open to various employment-related exposures. EPLI was created to round out your business insurance needs by offering protection against employee lawsuits. EPLI protects the assets you’ve worked so hard to attain and provides coverage to help your business recover from loss or litigation.

The Employment Practices Liability coverage endorsement provides you with protection against administrative proceedings and lawsuits alleging:

- Wrongful employment practices, including failure to hire or promote and wrongful discipline or termination

- Employment-related discrimination

- Third-party (customers or vendors) discrimination or harassment

- Employment-related sexual and other harassment

- Retaliation

- Employment-related defamation or infliction of emotional distress

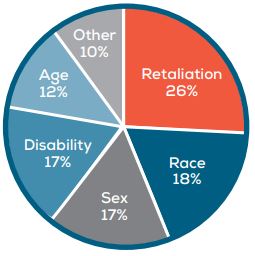

EEOC DISCRIMINATION COMPLAINTS4

Coverage may not be available in all states.

Policy terms and conditions control.

1-4 Employee charge and other EEOC statistics from U.S. Equal Employment Opportunity Commission, www.eeoc.gov.

Fiduciary Liability Insurance

The Fiduciary Liability coverage is offered through PMC Advantage Insurance Services, Inc., a wholly owned subsidiary of Pharmacists Mutual Insurance Company. Fiduciary Liability insurance covers the trustees of an employee benefit plan against claims alleging breach of their fiduciary duties, including claims that might involve discretionary judgment or poor judgment when investing funds.